Alignment: CFO<>Tax or CFO><Tax

I began digging into the alignment between CFOs and tax departments because nearly every tax team I meet is running at its limits, working with legacy tools, coping with rising mandates, and translating finance’s strategic objectives into daily execution. All too often, finance priorities don’t reflect the realities tax teams face on the ground. As the pace of regulatory change accelerates and both talent and budget pressures mount, any disconnect between these two groups becomes a real source of business risk. My aim in this analysis is to pinpoint the leverage points where better alignment, smarter technology, and process clarity can help both functions move beyond constant firefighting. Tomorrow’s challenges are already today’s realities; it’s time to get ahead.

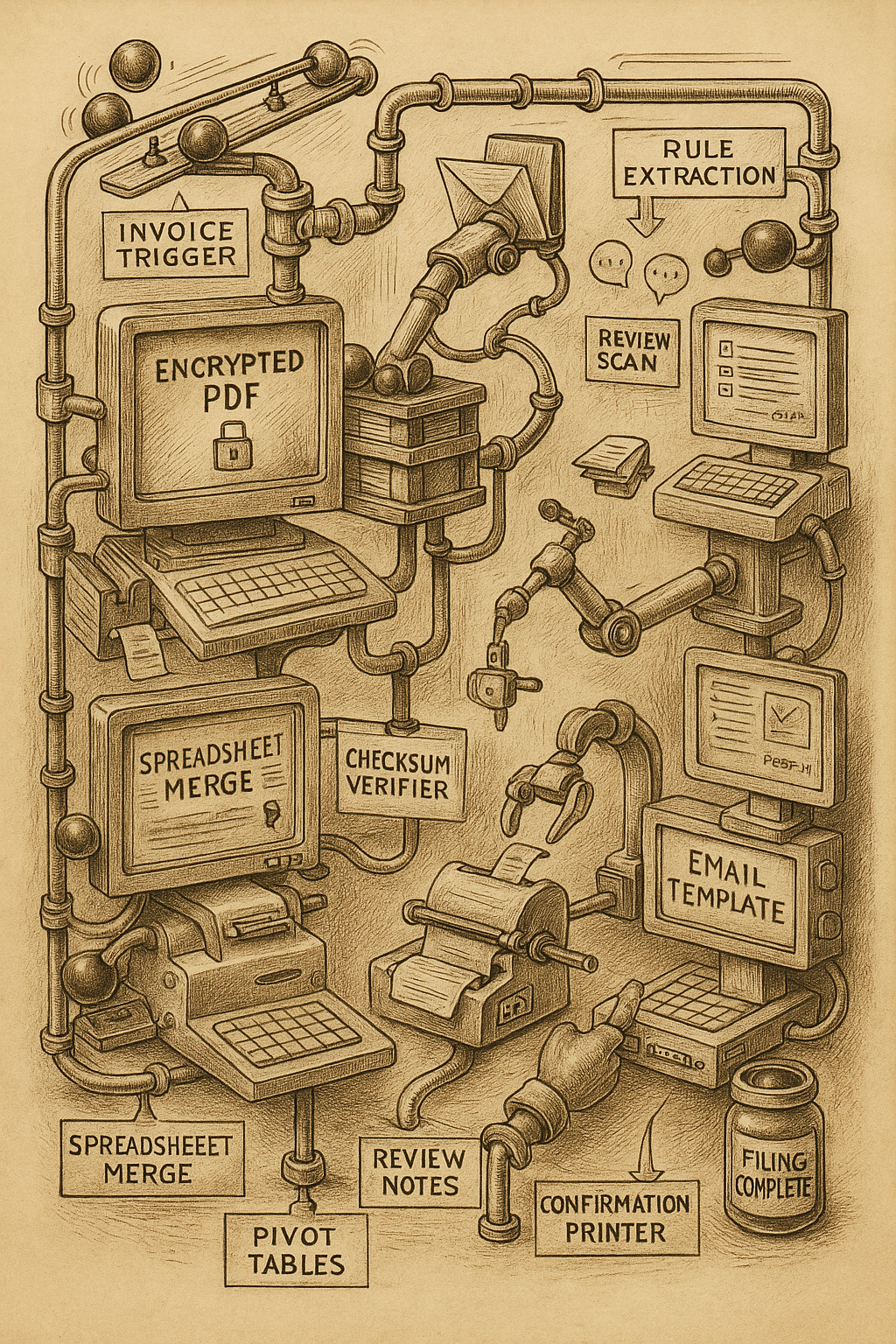

Talk of a “talent shortage” misses the deeper truth. Invert your thinking. The real bottleneck isn’t lack of bodies, it’s the explosion of rules, filings, and process detritus that grows with each passing year. Each rule change brings changes to existing processes or requires creating new ones. Old processes morph into Rube-Goldberg-like monstrosities.

Teams can usually execute the steps, but anyone new can’t understand why tasks are performed a particular way. This can be like removing Chesterton’s Fence: unless you understand the reason behind every legacy step, pulling any thread could unravel critical controls. Each round of new requirements gets layered atop the last, creating fragile, labyrinthine workflows that resist simplification. The result is a system where process improvement means not just adding tech, but reconstructing the logic in plain sight; no easy feat when the institutional memory is incomplete.

Framing it as “too many rules, not too few people” doesn’t solve the problem though. It does, however, open up different paths to (partial) solutions.

Will AI Fix or Fuel the Flood?

It’s tempting to see AI as an escape hatch. Finally! A way to automate away drudgery! But the reality is double-edged. As writing, analysis, and rulemaking speed up, so does the creation of new rules and compliance demands. There’s a real risk that AI will increase the pace and complexity of change, not just help teams keep up. When lawmakers themselves can rapidly draft new guidance, the wave of requirements hits harder and faster.

The most effective defense? Fight AI with AI. Deploy intelligent tools not only to automate and document, but to help teams anticipate, interpret, and adapt in real time.

The Catch-22: No Time to Learn, No Space to Redesign

The fundamental tension remains: most tax teams are so consumed by the daily grind of interpreting and applying rules to the business (compliance in other words), they have little bandwidth for process redesign or meaningful upskilling. Even when leadership sees the value of new technology or process reform, teams rarely have protected time or resources to invest in learning. True process improvement demands a level of technical fluency that can’t be acquired in passing. Many teams are stuck: the “old way” persists because nobody has time (or incentive) to fully deconstruct it, let alone reconstruct something better. This is where advisors and external solutions can step in to help.

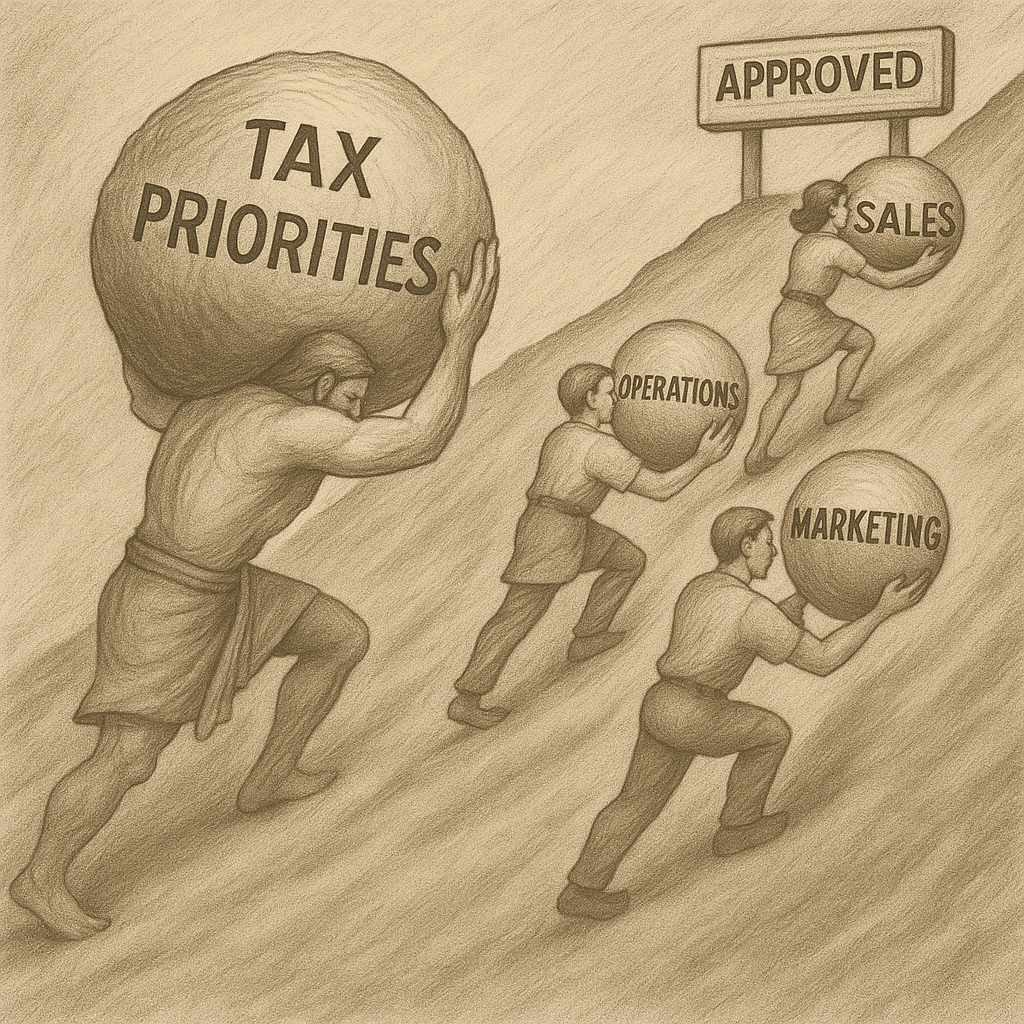

Strike When the Iron Is Hot

Within most organizations, tax priorities are always in competition, jostling for budget, talent, and the critically important IT resources next to every other function’s projects. That’s why timing is everything. When the CFO puts technology, efficiency, or process reform at the top of the agenda, seize that moment. Use it to present a case for investment, showing how AI can do more than automate tasks: it can make your team’s work visible, measurable, and strategically necessary.

Come prepared and bring a concrete proposal for where AI can free bandwidth, retain hard-won knowledge, or eliminate a chronic process pain.

AI’s value in the two high-impact alignments:

Process Transformation: AI as Your Mapping and Execution Engine

AI can act as your process mapping engine, exposing hidden redundancies, clarifying who does what and how, and flagging “we’ve always done it this way” routines for real scrutiny. Even better, it helps triage which steps are suited to traditional automation, which need smarter AI coding, and which demand human judgment. This is your chance to shrink manual effort, patch fewer workarounds, and position your tax team as a driver—not just a cost.

Talent: AI as Your Institutional Memory and Support

The profession faces a well-documented crisis: the silver-tsunami of retirements, falling CPA entries, and widespread burnout among mid-career leaders like yours truly. The cavalry isn’t coming. Instead, the practical response is to make AI an always-available coworker: to help train, document, and extend the reach of the experienced people you have.

By 2026, organizations will have access to AI coworkers modeled after top-tier professionals, able to interpret regulatory changes, draft documentation, and spot issues in complex filings in seconds, not the hours or days it currently takes. This isn’t hype. Outside platforms and expert-driven partners, like Innovation Algebra, are building specialized AI expert personas modeled on real experience directed by the very same (real) experts themselves. You don’t have to jump right into agents and personas, but you must start somewhere. Bottom line: When finance leadership is signaling readiness to invest, don’t just hope tax will get swept along. Bring sharp, actionable proposals for where AI will relieve pressure, capture knowledge, and make the department a magnet for future-facing talent. Passivity means missed windows; boldness means lasting impact

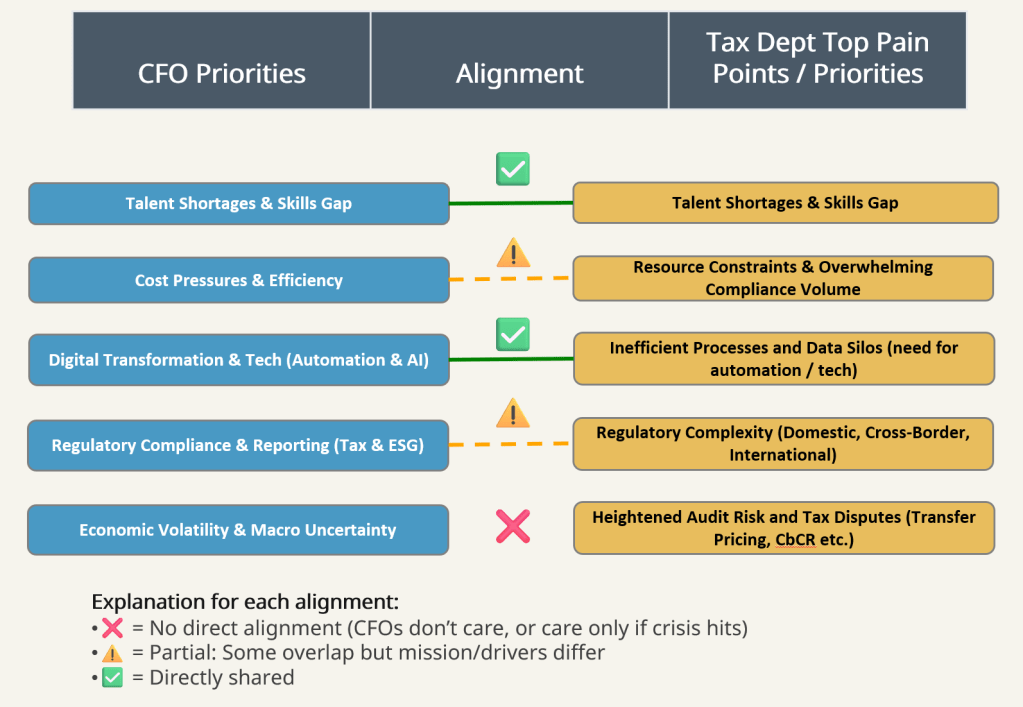

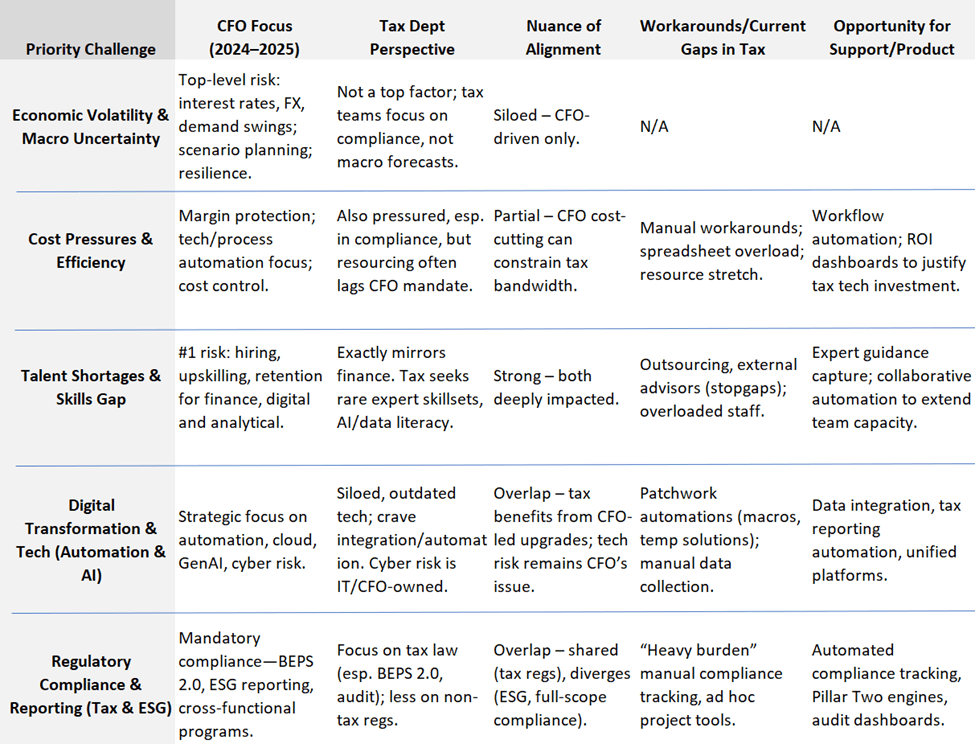

Appendix – Expanded Prioritization Matrix

CFO Priorities Sources: BDO 2024 Middle Market CFO Outlook, Deloitte CFO Signals , PwC Canada CFO Insights, KPMG Canadian Private Enterprise Survey, Protiviti Top Risks for CFOs analysis, recent industry research.

Tax Department sources: Thomson Reuters 2024 State of the Corporate Tax Department (thomsonreuters.com), PwC Tax Policy Alert – BEPS 2.0 Compliance (pwc.com), BDO Global Tax Outlook Survey Insights (bdo.ca), Tax Adviser Magazine – BDO Global Survey 2024 (taxadvisermagazine.com), EY 2023 Transfer Pricing Survey (ey.com), Statistics Canada 2024 Industry Data (statcan.gc.ca), recent industry research.